Rumored Buzz on Custom Private Equity Asset Managers

Wiki Article

Things about Custom Private Equity Asset Managers

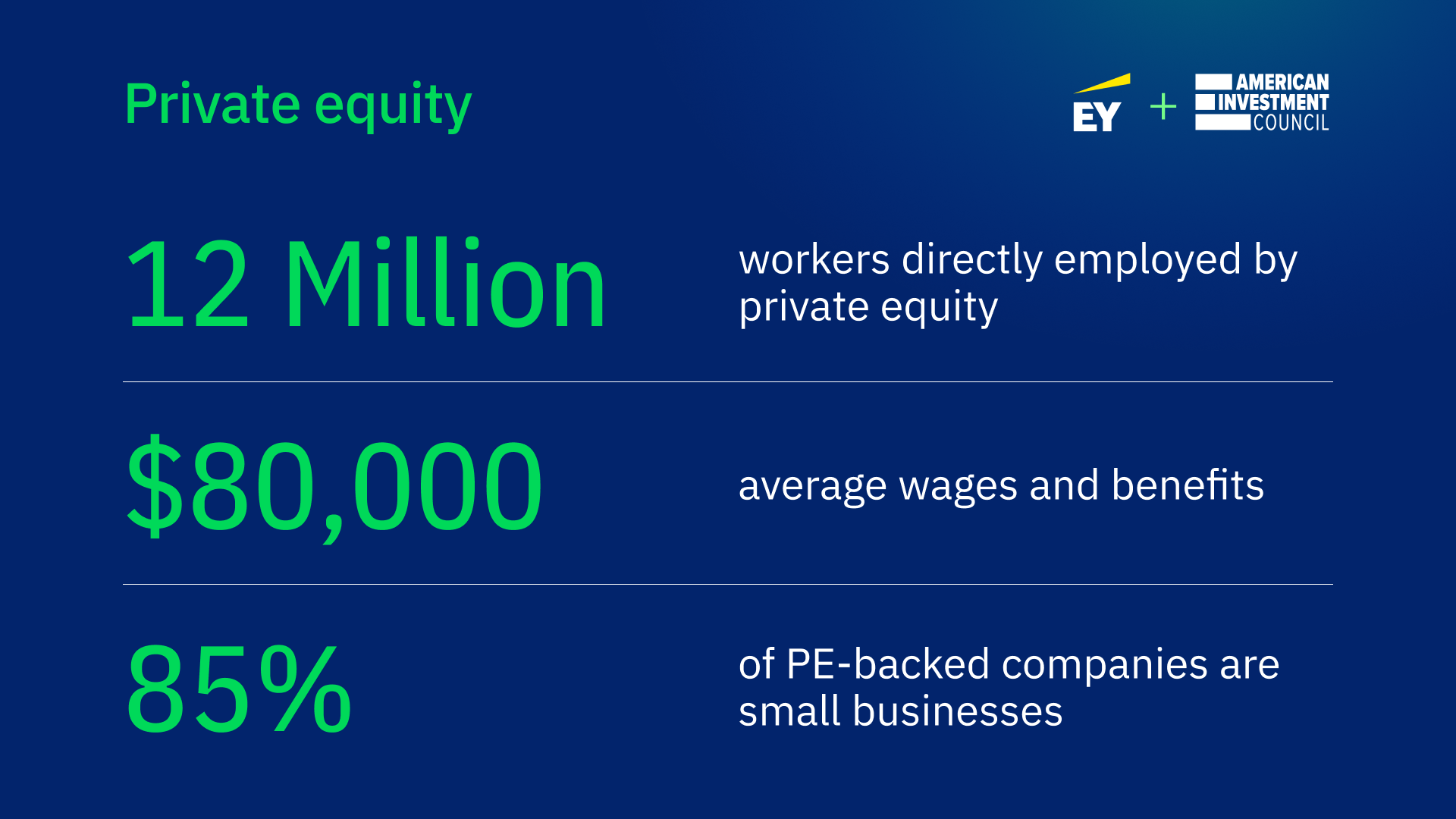

(PE): spending in companies that are not openly traded. About $11 (https://triberr.com/cpequityamtx). There may be a few things you don't recognize about the sector.

Exclusive equity companies have an array of financial investment preferences.

Due to the fact that the very best gravitate toward the larger offers, the center market is a dramatically underserved market. There are a lot more vendors than there are very skilled and well-positioned financing experts with considerable buyer networks and resources to take care of a bargain. The returns of private equity are typically seen after a couple of years.

Facts About Custom Private Equity Asset Managers Revealed

Traveling listed below the radar of big multinational companies, much of these little business typically provide higher-quality customer care and/or niche services and products that are not being supplied by the huge check my site corporations (https://canvas.instructure.com/eportfolios/2568385/Home/Unlocking_Prosperity_Private_Investment_Opportunities_with_Custom_Private_Equity). Such benefits attract the interest of private equity companies, as they have the insights and savvy to make use of such opportunities and take the business to the next degree

Personal equity capitalists need to have reliable, qualified, and reliable monitoring in place. The majority of managers at portfolio companies are provided equity and bonus compensation structures that compensate them for hitting their financial targets. Such positioning of objectives is generally needed prior to a deal gets done. Personal equity opportunities are typically unreachable for individuals who can not spend numerous bucks, but they should not be.

There are policies, such as limitations on the accumulation quantity of money and on the number of non-accredited capitalists (TX Trusted Private Equity Company).

Facts About Custom Private Equity Asset Managers Revealed

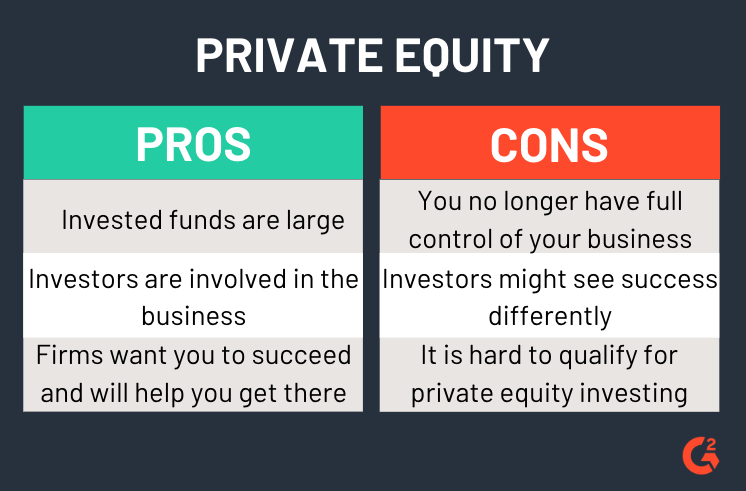

One more drawback is the lack of liquidity; once in a private equity deal, it is not easy to get out of or market. With funds under administration currently in the trillions, private equity companies have actually become attractive investment automobiles for rich individuals and establishments.

For decades, the characteristics of private equity have actually made the property course an eye-catching suggestion for those who might participate. Now that access to personal equity is opening approximately more private capitalists, the untapped potential is coming to be a reality. The question to think about is: why should you spend? We'll start with the major arguments for purchasing exclusive equity: Exactly how and why exclusive equity returns have actually historically been more than various other possessions on a number of levels, Exactly how consisting of private equity in a portfolio impacts the risk-return profile, by assisting to expand against market and intermittent danger, Then, we will detail some vital factors to consider and dangers for personal equity financiers.

When it pertains to introducing a new property into a portfolio, the a lot of fundamental consideration is the risk-return profile of that asset. Historically, personal equity has actually exhibited returns comparable to that of Emerging Market Equities and greater than all various other conventional possession classes. Its fairly reduced volatility combined with its high returns makes for a compelling risk-return profile.

Examine This Report on Custom Private Equity Asset Managers

As a matter of fact, personal equity fund quartiles have the best series of returns throughout all alternate property courses - as you can see listed below. Method: Internal rate of return (IRR) spreads calculated for funds within classic years separately and afterwards balanced out. Mean IRR was calculated bytaking the average of the typical IRR for funds within each vintage year.

The result of adding exclusive equity right into a profile is - as always - reliant on the portfolio itself. A Pantheon research from 2015 suggested that consisting of personal equity in a portfolio of pure public equity can unlock 3.

On the other hand, the very best exclusive equity firms have accessibility to an also bigger swimming pool of unknown chances that do not encounter the exact same analysis, in addition to the sources to carry out due persistance on them and determine which are worth purchasing (Private Investment Opportunities). Investing at the ground flooring implies greater danger, but also for the firms that do succeed, the fund advantages from greater returns

Top Guidelines Of Custom Private Equity Asset Managers

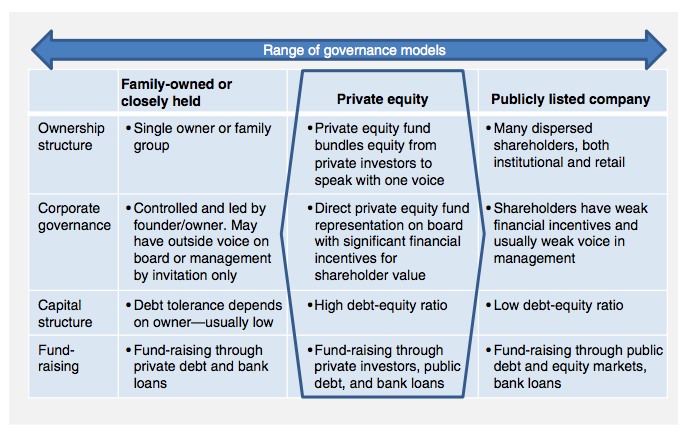

Both public and exclusive equity fund supervisors dedicate to investing a percentage of the fund however there continues to be a well-trodden problem with straightening interests for public equity fund monitoring: the 'principal-agent issue'. When a financier (the 'principal') hires a public fund supervisor to take control of their funding (as an 'agent') they delegate control to the supervisor while keeping ownership of the assets.

In the case of private equity, the General Partner does not just make a monitoring cost. Personal equity funds additionally alleviate an additional type of principal-agent trouble.

A public equity financier ultimately desires one point - for the administration to raise the supply price and/or pay out returns. The investor has little to no control over the choice. We revealed above just how several personal equity techniques - especially bulk acquistions - take control of the running of the company, guaranteeing that the long-lasting worth of the company comes initially, raising the return on financial investment over the life of the fund.

Report this wiki page